1-800-805-5783

1-800-805-5783

The Global Mobile Banking Report 2015 by KPMG predicts that the number of mobile banking users worldwide will double to 1.8 billion over the next four years, accounting for over 25% of the world’s population.

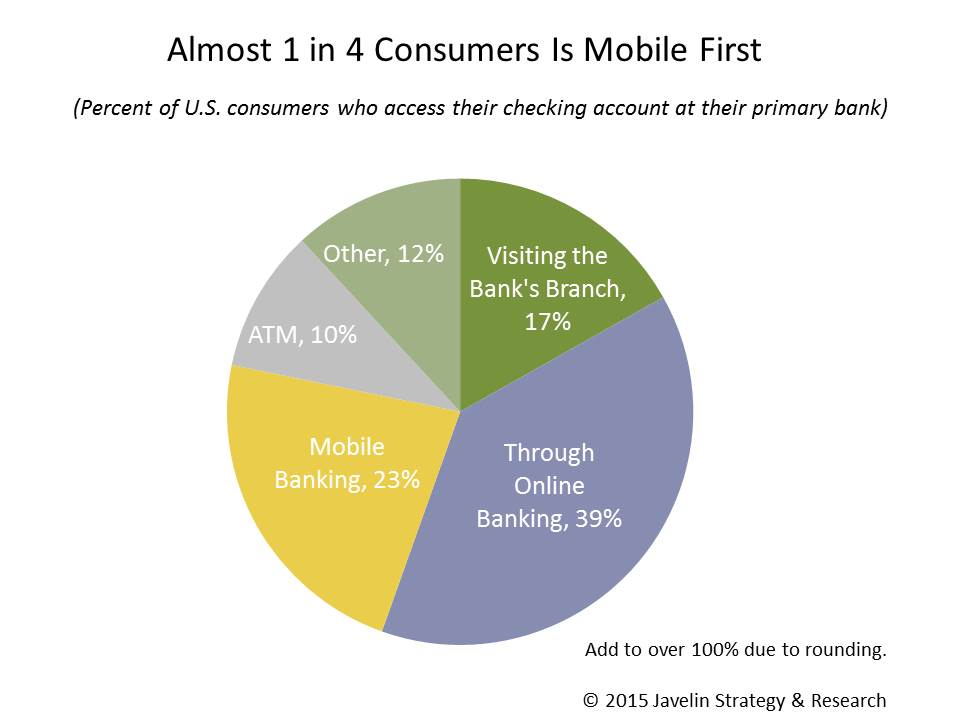

The banking landscape has changed over the years. Massive shift in consumer behavior and expectations, regulatory challenges and emergence of new technologies present new challenges to banks. In the new banking environment, banks are adopting ‘Mobile First’ approach to serve customers better and stay competitive.

The changing landscape Mobile Phone and Tablet Usage are soaring. Access to mobile networks is now available to 90% of the world population and 80% of the population living in rural areas.

Mobile banking, which started off with banks offering services like balance inquiries, checkbook requests, etc., via SMS and later with the browser through WAP and GPRS, has, over the years, widened its scope to include a huge part of banking operations, both internally and externally. Today, banks are adopting a mobile first strategy and investing heavily into mobile and other related digital technologies like cloud, social, wearables and Internet of Things. As mobility takes center stage in the technical infrastructure of banks, business processes are being reengineered and new models are being explored. Mobile payment processing, location-based services, add on devices, etc., has led to a greater extension of mobile solutions enabling banks to provide the seamless banking experience to their customers.

Today, banks not only use mobile devices and applications as a channel to offer services to customers but also as a tool to connect within the organization, empower their workforce and control its various processes and assets. So, we not only see basic banking operations performed through mobile devices and applications, but we also see increased use of mobility solutions within the organizations for complex operations like asset management services, loan approval processes and database management.

The customer’s attitude towards mobile banking has also undergone a sea change. Far from being wary of doing financial transactions on mobile, as was the case in the early days, people, owing to ubiquity and convenience today, have nicely warmed up to the concept of banking on their devices and are pretty comfortable paying utility bills and transferring funds on the go.

Several factors are at play behind the growth of mBanking or mobile banking–Smartphones and tablets have become ubiquitous. Consumers are welcoming banking services on their devices. Internet connectivity has widened its spread and is getting faster. Mobile apps are more powerful and secure enough to integrate with banking processes and operations. While powerful game changing drivers like faster ROI, higher productivity and a direct and personal communication channel with the customer base have attracted banks to embrace mobility, customers are excited about quick anywhere anytime services.

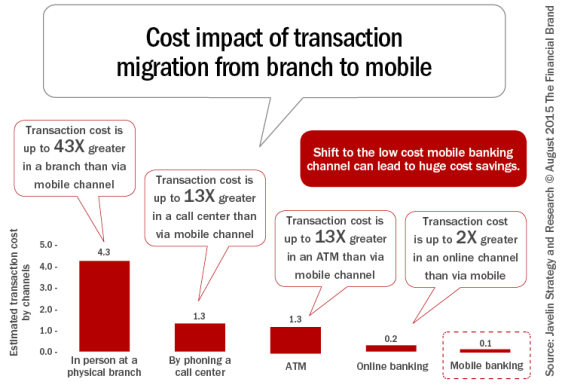

Source: The Financial Brand

Source: The Financial Brand

One of the significant benefit that has made banks embrace mobile technology is cost efficiency. The above graphic illustrates how mobile can bring significant cost efficiency in transactions.

Mercatus LLC Survey on mobile banking discovered some interesting results, validating how mobilizing operations and services can boost customer acquisition, brand perception and sales. The report reveals that–

Retail banks are mostly using mobile in following ways

Payments: Banks are rapidly leveraging mobility solutions to enable customers to use their mobile devices to make payments at stores. Similarly, efforts are ongoing to facilitate person-to-person payments, allowing money to be transferred from one person to another like PayPal.

Branch less Services: What about the ability to deposit documents like checks, pay order, etc., by simply scanning the check and sending the image to the bank rather than depositing the physical form in the bank?

Customer Engagement: Mobile apps can help banks engage with customers, offer real-time advice/suggestions for up-sell/cross-sell based on the past history and make banking fun via gamification, contests etc.

Location based Services: Many banks have already embraced the location-based capabilities of mobility solutions to locate ATM’s, bank branches, etc.

Within the organizations, powerful enterprise solutions have facilitated a spectrum of services on mobile devices. Bank employees today not only use mobile devices to connect and interact within the organization through email, messenger etc., but also use it to access various company resources like Management Information Systems, Transaction Management and Sales Force Automation, etc. Mobility solutions for banking are making processes leaner and quicker not only with their own might but also by complementing other technologies.

Today, mobility for banking is not only a viable medium but also an enabler that can act as a force multiplier for other channels. Mobile applications are quickly replacing bank mobile websites by providing a better experience and secure transactions. With wearables like Google Glass and Smart Watches gaining traction among customers; some banks have started experimenting by proving banking services on wearables. Some banks have also introduced mechanisms that enable interaction between the ATM and the mobile devices of the customer. Armed with a smartphone or tablet, a user can connect his device wirelessly to the ATM, authenticate and make a withdrawal or transfer fund s through it without a debit or credit card.

The ride, however, is not so smooth. There are multiple challenges facing the banks as they move to leverage mobility solutions. The biggest impediment is banks struggling to creating a comprehensive mobile strategy resulting in mobile implementation in silos. There is a massive proliferation of devices differing in form, functionalities and features. The challenge will be to come up with one solution that fits all and offers seamless experience across.

While the world may be stepping into 4G, bandwidth latency and coverage is still an area of concern if mBanking is to adhere to its promise of anywhere, anytime banking. The security of banking transaction over the air is another complicated challenge which calls for continuous intervention as the technology evolves. Decision makers should also keep an eye on the scalability and reliability of their mobile infrastructure as the usage grows and mobile devices become the major channel instead of just yet-another-channel of contact between customers and the branch.

The trends point towards a future where banking will be real-time,anytime with mobile being the key enabler. New technologies like Big Data, Internet of Things, Cloud etc., will further build on the mobile and bring a paradigm shift in banking. Tapping into the opportunities available will help banking institutions derive enduring value.

Embrace mobility: Mobile banking is here to stay. It offers tremendous value to both banks and customers. The opportunities are endless.

Devise clear strategy: A comprehensive strategy encompassing your people, processes and services will help you better leverage mobile and get higher RoI.

Focus on consumer experience: Create an omni-channel, user-friendly and secure mobile banking environment.

Pick the right platform: Diversity in screen sizes, functionalities and operating system necessitates banks to adopt a multi-platform approach.

Turn data into Insights: Monitor user behavior leveraging advanced analytics tools. Customer intelligence will be the guide for future.

Lay down the groundwork for next generation of m-banking: Emerging technologies like IoT, Wearables etc., promises more opportunities. Be ready to seize them.

The world of convenience banking on mobile phones and tablets is very engaging. A powerful value proposition! However, it is just the beginning. The swift pace of change in mobile technology is opening new opportunities, driving innovation and prompting banks around the world to ask “What else?” This is a big shift from, “Why go mobile?” a few years back. The evolution has led many banks to not only see mobility as an enabler towards greater customer access to their services, but also as a game changer in the disruptive world.