1-800-805-5783

1-800-805-5783

Think about a world where your bank could process millions of transactions in seconds, spot fake activity before it happens, and give you financial advice that’s just right for you. It’s the future of finance powered by Artificial Intelligence – AI in Finance.

AI in Finance is like a highly skilled digital assistant with extensive data analysis capabilities. It can identify hidden patterns and automate routine tasks. This digital assistant role should support and guide you in your financial decisions.

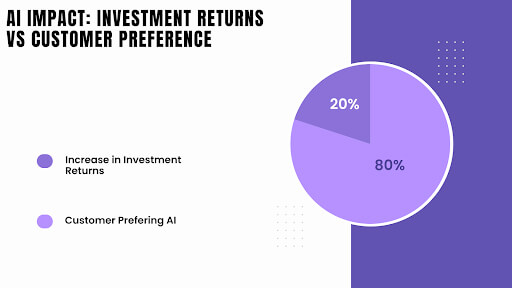

For example, a large investment bank recently used AI in Finance to explore over 100 million data points to identify potential market anomalies, resulting in a 20% increase in investment returns.

But Generative AI in Finance isn’t just about efficiency; it also involves enhancing your experience. AI-driven chatbots and virtual assistants can offer individualized client service 24/7, ensuring you always have the help you need whenever you need it. A recent survey found that 80% of customers prefer interacting with AI-powered virtual assistants over human representatives.

Artificial Intelligence in Finance is transforming the financial sector in sweeping dimensions with innovative solutions for traditional challenges. Advanced algorithms and techniques regarding machine learning enhance efficiency, reduce risks, and improve customer experiences for financial institutions.

By leveraging AI’s capabilities, financial institutions have streamlined operations, enhanced decision-making, and improved customer experiences. Let’s explore real-world examples of successful AI Finance implementations in finance.

JPMorgan Chase, one of the world’s largest financial institutions, pioneered using AI in Finance for contract analysis with its Contract Intelligence (COIN) system. This AI-powered platform can review and understand legal documents in seconds, a task that traditionally took human lawyers hours or even days.

By automating this process, COIN has significantly increased efficiency and reduced costs for JPMorgan Chase. According to the bank, COIN can process 12,000 documents per hour, allowing lawyers to focus on more complex tasks.

Bank of America’s Erica is a groundbreaking AI-powered virtual assistant that provides customers with personalized AI in banking and finance services. Erica can help with various tasks, such as moving money, paying payments, and verifying account balances.

The introduction of Erica has led to a significant improvement in customer satisfaction at Bank of America. Consumers value the effectiveness and ease of communicating with their bank via brief talk around the clock.

Goldman Sachs, a leading investment bank, has developed an AI-driven trading platform that executes trades faster and more accurately than human traders. This platform analyzes data using machine learning methods to identify profitable trading opportunities.

Goldman Sachs’s AI in Finance trading platform has increased profitability and reduced risk for the bank. By automating the trading process, the bank has been able to capitalize on market trends more effectively and minimize losses.

AI in Finance has revolutionized financial process automation, from fraud detection to personalized investment advice. However, fast adoption has also thrown up many challenges and issues that must be addressed seriously.

Data Quality and Privacy: The Necessity of AI

Data quality forms the backbone of AI applications. Data quality remains essential in finance, where high accuracy and precision are required. Inconsistencies, missing values, and outliers can drastically impair the functioning of AI models.

Some other significant concerns involve privacy. Financial institutions handle the most sensitive customer data; a breach can have devastating consequences. Therefore, the most important thing is installing robust security measures and strictly adhering to data privacy policies such as GDPR.

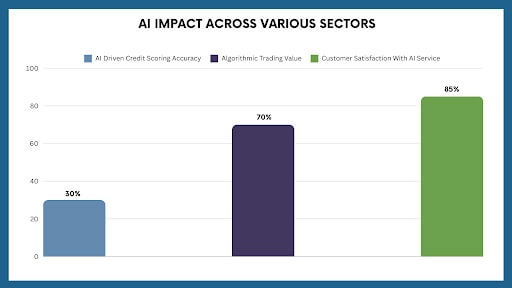

As McKinsey cites, 70% of financial institutions found that improving data quality is essential for the success of AI in Finance.

Ethical Issues: Navigating the Moral Compass

AI in Finance can exhibit bias and cause discrimination. Algorithms that learn from skewed data are more likely to continue this trend. For instance, a credit scoring model that denies a disproportionate number of loan applications to people from specific demographics could further create financial disparities.

Again, job loss is another ethical issue. As AI in Finance replaces traditional manual work, it may lead to job loss. Essential strategies must be devised to absorb losses, including training workers for other new activities.

According to a recent report by PwC, AI in Finance will create up to 12 million new jobs by 2030 and replace 7.7 million jobs.

Integration and Implementation: Connecting the Dots

AI solutions integrated into existing financial systems create challenges. Technical barriers include compatibility issues and legacy systems. The safety and reliability of such AI-driven systems in Finance must also be assured.

Implementing such processes takes work, careful thought, and proper action. To establish this new track of AI in Finance adoption, financial institutions would need to invest in talent, infrastructure, and governance.

According to an Accenture survey, 83% of financial services executives believe AI will fundamentally change the nature of their industry.

It has immense scope for improving efficiency and effectiveness in financial institutions. However, data quality, privacy, ethics, and integration challenges must be addressed before AI in Finance can fully reap its benefits. By navigating these intricacies with care, the financial industry can tap into AI’s power to advance an innovative, inclusive, and sustainable future for all.

In conclusion, AI in Finance is poised to play a pivotal role in the future of finance. By leveraging AI’s power, financial institutions can enhance efficiency, reduce risks, improve customer experiences, and stay ahead of the competition. As AI in Finance technology evolves, we expect to see even more innovative applications in the financial sector.

As AI in Finance continues to evolve, its potential to transform the financial industry is immense. Financial institutions can improve operational efficiency by embracing AI and gaining a competitive edge. This transformation should make you feel excited about the future of finance.

The future of finance will likely be characterized by a seamless integration of AI into every aspect of the business, from back-office operations to front-line customer interactions. And while AI in Finance will undoubtedly play a crucial role, it’s important to remember that it’s a tool to empower humans, not replace them.

What are the gains of using AI in finance?

AI benefits the finance industry in several ways, including:

What are the potential risks associated with AI in finance?

While AI offers many benefits, it also presents some risks, such as:

How can financial institutions address the ethical concerns surrounding AI?

Financial institutions can address ethical concerns by:

Which financial applications of AI are there, for instance?

AI is being applied in several financial domains, such as:

[x]cube has been AI-native from the beginning, and we’ve been working with various versions of AI tech for over a decade. For example, we’ve been working with Bert and GPT’s developer interface even before the public release of ChatGPT.

One of our initiatives has significantly improved the OCR scan rate for a complex extraction project. We’ve also been using Gen AI for projects ranging from object recognition to prediction improvement and chat-based interfaces.

Interested in transforming your business with generative AI? Talk to our experts over a FREE consultation today!