1-800-805-5783

1-800-805-5783

Table of contents

Innovation is the law of tomorrow. Disruption has occurred in all industries and is also transforming the financial sector. Banks, which maintained their predominant position due to highly regulated environments, are witnessing the emergence of new competitors that jeopardize stealing a substantial market share.

Perhaps the most astonishing and worrying phenomenon for traditional banking is that these new financial competitors are innovating and expanding.

Transferring Cash from one account to another with a tap of a button and depositing a cheque by clicking just a picture of it are two of the standard mobile banking features banks provide customers. Before we dive further in, let us understand,

Financial organizations are taking cues to adopt more sophisticated technologies like big data, blockchain, and machine learning end-products to retain customers. Most competitive banks offer mobile banking to complete financial transactions via smartphone or tablet. To meet the growing market needs of digitally-savvy millennials and Gen Zers, digital and legacy banks will continue to adapt to mobile banking market trends to stay relevant. According to a study, The global mobile banking industry will reach $1,824.7 million by 2026.

Alt Tag for Image 1- Digital Banking Solutions

Let us understand the Trends of Mobile Banking in 2022

A robust mobile banking infrastructure rides on the wave of the highest forms of digital security, and using biometric technology has only quickened the pace of this. Embracing critical points of biometric identification systems like facial recognition, voice recognition, fingerprint scans, and iris scans are becoming the go-to security standards globally.

Biometrics will replace PINs completely and render them obsolete shortly. Research states that 56% of consumers trust biometric techniques to authenticate transactions, and the expected market size will reach $24.59 billion by 2023. It would be fair to say that biometric technology will be the next significant thing to be embraced across all verticals of the financial landscape.

Chatbots are conversational AI-powered methods that have become a benchmark model in the banking sector. Three significant requirements are needed for adopting chatbots –

By delving into personalized consumer data and conversations that help solve their pain points, the financial industry uses chatbots to boost operational efficiencies and deliver a holistic customer experience.

Sectors that manage vast volumes of human interaction, like banking, are deploying chatbots into their products. This is greatly decreasing dependency on physical customer service teams and forwarding queries to chat agents.

Big Data has contributed tremendously towards allowing banks and other financial institutions to collate customer-centric data from traditional and digital sources and provide a personalized banking experience.

Other than this, another critical use case of big data is stopping fraudulent activities using AI-based algorithms. Furthermore, by identifying their customers’ transaction patterns and banking history, important information assists banks in pointing out deviations and detecting suspicious activities.

For example, we can immediately freeze a customer’s credit card if transactions occur simultaneously in separate parts of one country.

A card provider can predict general trends with big data by analyzing customers’ information and identifying fraudulent behavior before the card or account is compromised.

Mobile banking can succeed on the idea of the absence of physical branches altogether and adopting a cloud-based system of banking experience that will do all the work.

Blockchain has been around for a while now, and the financial sector is keen on adopting it to improve its speed, efficiency, accuracy, and security. The adoption of blockchain has helped this by diverting the focus from digital-only banking. The Financial Industry is trying to experiment with blockchain by replicating existing asset transactions on the blockchain. While this allows for the efficiency of a blockchain solution, what gets missed out is the ecosystem implications of a blockchain solution.

In infrastructure terms, a blockchain is open-source software built to support the real-time transfer of digital assets amongst market participants. Using any selected blockchain’s APIs, we can see a surprising reduction in asset transfer costs and timelines. Most bank implementations today are focused on the same aspect. However, while scaling proof of this concept into a real-world scenario, financial institutions implement the same application layer with all the current checks and balances.

The pandemic hit the reset button for the industry. Swathes of statistics emphasize the success gained and the ground covered by industry entrants during the last decade. Before 2020, incumbent banks were somewhat away from new, more agile competitors.

Legacy banks and their ilk have taken a massive hit since the pandemic’s beginning. Reports suggest that customers are more risk-averse during difficult times. Even though traditional banks are not skyrocketing in terms of gaining trust from end consumers, they are preferred and stable choices for more than a few.

It is a given that the legacy banks should have been on the frontline of a digital revolution. Still, the impact of COVID-19 demanded more digital banking services and bandwidth than ever before. However, customers stuck with the traditional industry players rather than flocking to new digital-only banks during the pandemic.

Despite this sudden surge, traditional banks may not have progressed in market demand. A deeper look at some figures around the current state of legacy banks’ digital transformations makes for a somewhat grim reading.

It may seem that legacy banks have not made as many inroads into the digital future as they need to compare to progressive digital players. Legacy banks will have to change this because customer expectations are becoming increasingly digital-focused, reflected in their banking attitude.

A report by EY states that many customers say that their banking practices varied over the long term because of COVID-19.

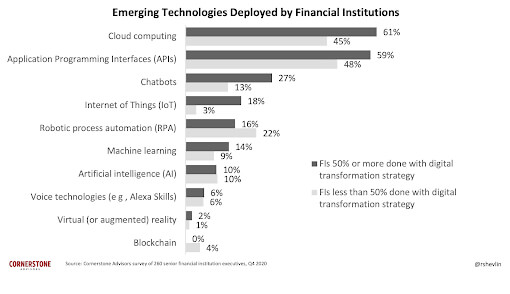

Lack of progress is an evident lack of awareness from some banks where they must be on the digital roadmap. According to the Cornerstone Advisors study that cites the developments above, over a third of banks believe they’re more than halfway through their digital transformation.

Legacy banks have made many digital strides during the pandemic, edging closer towards digitization. Suddenly, they no longer play catchup and face imminent disintermediation. However, the job is not done here; one could even argue that the job will not be done because of the ever-evolving digital technology; instead, digital transformation is constantly changing and adapting. For now, traditional banks can reflect on how far they’ve come since the pandemic’s beginning and pause on what could be regarded as a sector reset.

But it’s an action that should be taken quickly. Any complacency will quickly see legacy banks lose ground to a new wave of resurgent digital players.

Technologies will continue to evolve, existing challenger banks will regroup, and new ones to challenge the current status quo.