1-800-805-5783

1-800-805-5783 ![Immersive Technology - [x]cube LABS](https://d6fiz9tmzg8gn.cloudfront.net/wp-content/uploads/2017/09/blue-sky1.jpg)

“The majority of global financial services companies plan to increase FinTech partnerships as 88% express concern they will lose revenue to innovators.”

-PwC

Immersive technologies such as Artificial intelligence (AI), Virtual reality (VR), Machine Learning (ML), Augmented reality (AR), and so much more are already transforming almost all industry sectors. Immersive technologies have played a gigantic role in revolutionizing Banking and Fintech industries.

Fintech term is a combination of two words “Financial” and “Technology” that is focused towards driving the new operating model in the financial services. Fintech has evolved significantly over the past few decades where technology has played a crucial role in driving innovation and evolution into the business model.

“A large majority of global banks, insurers and investment managers intend to increase their partnerships with FinTech companies over the next 3-5 years and expect an average return on investment of 20% on their innovation projects.”

-PwC

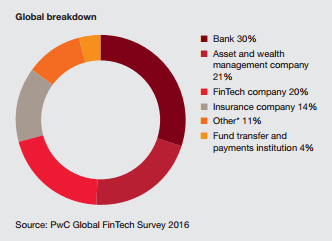

PwC survey report: The potential impact of FinTech in the Financial Service Sector:

As per the recent article published in Forbes, “Credit cards were introduced in the year the 1950s to ease the burden of carrying cash. ATMs were placed to substitute tellers and branches in the year 1960s. In the 1970s, electronic stock trading began on exchange trading floors. The 1980s saw the rise of bank mainframe computers and more sophisticated data and record-keeping systems. In the 1990s, the Internet and e-commerce business models flourished. The result was the introduction of online stock brokerage websites aimed at retail investors, replacing the phone-driven retail stock brokering model.”

According to PwC estimation, “Fintech companies have embraced this outlook wholeheartedly, becoming a dominant force in the global startup ecosystem. The cumulative investment in fintech globally could vastly exceed $150 billion within three to five years.

Immersive technologies are designing an advanced business that is going to lift fintech companies with billion of dollars in coming years. The conflux of Big Data, Virtual Reality(VR), Machine Learning (ML), Artificial Intelligence (AI) has produced a progressive environ for smart and automatic software that are built on data analytics, model identification, picture and natural language processing.

Immersive technologies pursue to grow at its surprising pace and it has been already predicted by the market experts that around two billion population are going to use mobile banking for their financial transaction by 2019. Most of the financial companies have already realized the importance of the immersive technologies and begin engaging and retaining customers by providing personalized customer service.

“Fin-techs are startup technology providers that deliver emerging digital technologies that approach financial services in innovative ways or can fundamentally change the way bank products and services are created and distributed and generate revenue. The term may also refer to the technologies these providers offer.”

-Gartner

Here are the four technologies that have dramatically revolutionized fintech

Now financial service providers have digitized every process and have already started experimenting with technology like Virtual Reality. It has opened a new opportunity to blend extraordinary interfaces with the ability to provide an immersive experience for the customer.

VR with its data visualization products is helping the financial companies to analyze the huge bunch of data. Financial leaders are able to comprehend complex concepts using VR and are able to recognize new model visually. Also, customers can ingress a wide picture with virtual reality headsets into extreme areas and act personally with a bank staff member.

Recently augmented reality (AR) has already escalated and built an enormous impact in the financial sector. There are so many AR mobile apps launched which help bank’s customer to scan and draw data on their way. For example, there are this “Home Finder” apps helps users to find properties for sale, rent and open houses around them. The Application uses AR technology that allows users to customize their search and show them the details with the photos of the properties in their smartphones. Users can contact the property dealer using the app and find a direction to the properties.

There are many risks involved when we do financial transactions. Decision makers have to be extra careful when they are dealing with everyday credit management, fraud detection, and so much more. It requires technologies that can rapidly refine all the data and deliver the authentic result.

Machine learning uses algorithms that allow machines to acquire knowledge from data and accordingly identify the framework to supply actionable understanding. As per the recent report, almost 40% of the time has been cut down by the tax issue by using ML technology in tax filing process. All data works are done by this machine learning technology in almost all financial companies.

Financial companies have seen a huge possibility in block chain for their future. Block chain has helped financial service providers to retain all sorts of digital operations in a concealed and tamper-proof manner. There is no chance for any fraudulent activity to occur as block chain only supports data that are encrypted and verified by each block. That means any corrupted data is easily identified and makes it impossible for hackers to break the chain.

The key feature of the blockchain technology enables the bank to eliminate all the third-party payment systems like NEFT and build their own means of processing the payments. The technology has helped fintech companies to establish “Know Your Customer” (KYC) process to recognize and verify the identity of its customers.

PwC reports, “81% of banking CEOs are concerned about the speed of technological change, more than any other industry sector.”

“There are many large forces sweeping the society, from demographic and social changes to shifts in global economic power. But one force in particular – namely, technological breakthroughs – is having a disproportionate affect on financial services”

-PwC

Fintech companies have truly recognized the potential of the immersive technologies in enhancing their business with new opportunities. It is impossible to imagine how financial service providers used to secure their customer’s sensitive data. With the high-end technologies available today, fintech companies are able to secure the sensitive data and can easily communicate with their customer from any part of the digital world. Immersive Technologies are going to create an enormous impact on fintech companies and hence, keep rolling out new opportunities across the board.