Growth of the Cryptocurrency and Blockchain Market in 2021 and Beyond

Table of contents

- Introduction

- The cryptocurrency scene

- COVID-19 impact

- Key factors fuelling growth

- What does the future look like for Blockchain?

- How does Blockchain help cryptocurrencies and other industries?

- Conclusion

Introduction:

It’s no secret that the Blockchain and cryptocurrency market is on the rise, with new currencies, and their values creating all the buzz. But how rapidly is the market growth in reality? It’s estimated that the worldwide market size will reach a whopping $1758 million by 2027, at a CAGR of 11.2%!

The cryptocurrency scene:

While the rise, proliferation, and adoption of cryptos have been in the news for long, several factors, hitherto unanticipated, have contributed to a massive spike in recent times. Enterprises across all major industries have come to accept that digital transformation is the way to go, resulting in the widespread implementation of Blockchain to solve key problems. The FinTech segment has also been quick to digitize currencies given the greater security and transparency it provides. Against that backdrop, the best cryptocurrencies were seeing a steady rise in popularity, and then COVID-19 happened.

COVID-19 impact:

The pandemic provided further impetus to the growth and usage of digital currencies. Across several key markets around the world, the exchange platform experienced a significant spike in trading transactions and the market caps of the currencies also shot up. With increasing digital adoption, the financial technology market is seeing major investments, giving the world state-of-the-art infrastructure that can handle a huge number of transactions securely. A KPMG study recently revealed that across Asia-Pacific, investments in financial technology had already exceeded 12.9 billion by Q4 of 2019. After the pandemic in 2020 and beyond, this number is only increasing and is slated to break all prior records in the coming years.

Apart from COVID and increasing investments, here are a few other factors driving the growth of cryptocurrencies.

Key factors fuelling growth:

Ease of Use: virtual or digital currencies such as Bitcoins, Litecoins, Ethers, and more are being used more in developed countries as people are finding the simple and flexible transactional methods easy and their long-term value lucrative. It’s simpler to buy and trade in bitcoins than traditional investment methods involving a bunch of paperwork and formalities.

Brand Support: when major companies and government bodies get behind a new system and use it actively, it establishes the system’s legitimacy and eliminates concerns about long-term feasibility. The Central Bank Digital Currency (CBDC) has added provisions for digital currency projects across many countries. Leading banks such as the Bank of Thailand, the Central Bank of Uruguay, Eastern Caribbean Central Bank, and the People’s Bank of China support cryptocurrencies as a medium of exchange. Couple that with organizations such as Facebook, which offer cryptocurrencies to expand their business, and you’ve got all the social proof that you need for peace of mind.

The In-thing: The culture around Bitcoin and other popular cryptocurrencies is playing a large part in attracting new investors and keeping existing investors in the space. According to many enthusiasts, the appeal of Bitcoin lies in the culture and “cool factor” that surrounds it. Add to it all the exclusive jargon, the conferences that see celebrity presence, close-knit communities, and you have the perfect recipe for success with the new generation.

Social Media Push: Influencers and celebrities regularly take to social media to talk about Bitcoin and other digital currencies, which go a long way in influencing the market and driving growth. Even for new currency launches, celebrity endorsements are sought after, to create the initial hype before the currency can take off. Popular platforms such as Reddit and Twitter have highly active and vocal communities that discuss everything crypto. As young, tech-savvy investors are also active users of social media, they are informed of all new developments and take the plunge as demand keeps driving growth.

The Challenge: Trading in cryptocurrency, and making the best out of it has become similar to a challenge that a lot of young investors enjoy. Leaving the comfort of “traditional and safe” savings options behind, the growing trend of high risk and high gains are influencing many, worldwide. The progress of cryptocurrencies is extremely dynamic, and things can change almost by the minute. Similar to a roller-coaster ride, such an experience is thrilling for those inclined to live for the present.

The Perceived High Value: just like gold, which has value because we have imparted the same to it, cryptocurrencies such as Bitcoin also have high values given to it by us. The more people invest in them and increase their value, the more people get attracted and hopeful that the price which they are paying for it will go up manifold, making them huge gainers. However, unlike gold, which has stood the test of time, can Bitcoin and others be as valuable as they are a few years down the line? The answer to that will be determined by how Blockchain evolves and the progress of digitization in this space as a whole.

Low Threshold for Entry: Though the price of Bitcoin has exploded over the years, one need not buy a full Bitcoin to grab a piece of the pie. Thanks to the currency being fully digital, it can be purchased in fractions so that one can invest a small amount and test the waters before going all in. Such small investments that can get someone a part of one of the most high-value currencies ever are enticing even more people to give cryptos a shot.

What does the future look like for Blockchain?

If we are to expand the statement made in the last paragraph about the value of cryptos depending on the future of Blockchain, investors would be happy to know that it’s not just FinTech where Blockchain is valuable, but it’s contributing to the transformation of many other major industries. With Blockchain-based innovation on the rise and increasing investments, the business value added by Blockchain is expected to grow to $360 Billion by 2026. Hence, if we are to look at continued Blockchain support to keep the cryptos secure, and valuable, it definitely will be available and get stronger.

How does Blockchain help cryptocurrencies and other industries?

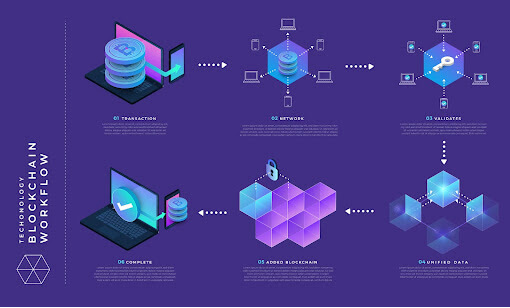

Increases security: The ability of Blockchain to create records that cannot be altered and its end-to-end encryption provides top-notch security and invokes trust in parties who otherwise do not know each other. The data within a Blockchain project is stored on a network of computers which makes data theft extremely difficult. Additionally, by making data anonymous and needing permissions to restrict access, Blockchain puts concerns about privacy to rest, effectively.

Decentralizes structure: Further to the first point, the fact that no single party is in charge of a Blockchain network, makes it even more trustworthy to people who are a part of it. If we take supply chain as an example, several businesses such as suppliers, producers, transport companies, distributors, retailers, and more want information out of the network, but they are at ease knowing that no one person or business among them have the power to control all the data and manipulate them at will

Reduces costs: By making transactions more efficient, eliminating manual tasks such as data collation and amendments, and simplifying reporting and auditing, Blockchain helps organizations save significant costs. Additionally, it also removes middlemen such as vendors and third-party service providers who used to process data, helping businesses save money as well as time.

Enhances speed: by removing intermediaries and simplifying processes, Blockchain also improves speeds considerably and enables enterprises to complete more tasks in a limited time. Though how fast transactions can be completed depends upon their complexity, size of data blocks, and network traffic, Blockchain can handle most transactions in seconds, resulting in major productivity gains.

Improves visibility and tracking: Blockchain also enables individuals and organizations to trace the origin of products and determine important factors such as quality, complaint history, reliability, and more. For retailers, this is extremely helpful as the information enables them to manage their inventory better, and communicate with customers reporting problems or asking questions. Retail experts who are using Blockchain, report that they are immensely benefitting from this added transparency by getting to know if a batch of products is original, or in the case of produce, organic.

For instance, we helped Panini America, the world leader in the published collectible sector, go digital completely, and then implemented a Blockchain-based solution for crypto-collectibles which:

- Ensures only authorized cards can be traded on the blockchain

- Maintains a record of total cards issued

- Eliminates hackable or fake digital cards

- Improves the value of cards by attaching exchange record of each card with different bids

- Helps users to easily validate a card as it can only be authorized by the issuer

- Easily maintains card value

Conclusion:

Looking at the future, crypto and Blockchain are here to stay. While no one can vouch for how well the various currencies will hold their value over the years, current trends show no sign of the hype slowing down. As for Blockchain, the technology is seeing innovation by the day, and its wide range of applications across all industries, definitely makes it something that business leaders must consider in their efforts at digital transformation. Speaking of Blockchain and finances, we have some fascinating stories to tell of how we helped leading financial institutions such as DBS Bank and HDFC launch crowdfunding platforms and insurance platforms. Do get in touch with us, and we’d be happy to talk about how you can leverage Blockchain for your enterprise.

Tags: bitcoin, Blockchain, cryptocurrency, ethereum, virtualcurrency

![Blog-[x]cube LABS](https://d6fiz9tmzg8gn.cloudfront.net/wp-content/uploads/2016/06/blog_banner.jpg)